Even when life is going well, managing our day-to-day finances takes time and sticking to a budget can be challenging

But what happens if something changes or goes wrong? A new report from leading Financial Wellbeing Provider, Neyber, tells us more.

Being uncertain about how to cope if we couldn’t work or were hit with an expected expenses leaves us feeling vulnerable and lacking the control we need.

This means making sure we have some way of paying for smaller things like unexpected bills, as well as protection policies in place for bigger problems such as losing a job, as a part of our financial planning.

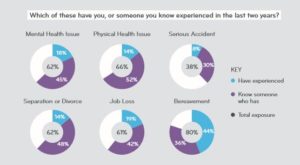

This year’s research showed that the majority of respondents have either experienced, or know someone who has experienced, difficult situations ranging from mental health issues, to divorce, job loss or bereavement.

Unsurprisingly, the findings supported the fact that life-changing events affect us all. Building a financial safety net isn’t just a nice-to-have, it’s an essential part of feeling in control of our money.

Neyber’s full report – the DNA of financial wellbeing – can be found here.