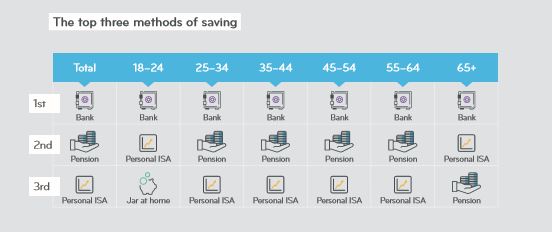

A new report from leading Financial Wellbeing Provider, Neyber, asked employees how they save money, and the results were consistent with findings from Neyber’s 2017 report: almost all age groups use banks, pensions, and personal ISAs as their most regular way of saving.

However, the methods that people use to save money vary hugely between the youngest and oldest age groups compared to those in the middle years of their working lives.

Those aged 18-24 are more likely to save into a personal ISA or a jar at home than save into a pension. That might reflect current pensions policy, which only requires employees aged over 22 to be automatically enrolled into a company scheme but it might also indicate that younger workers are keen to have accessible savings.

It’s also interesting to note that although a savings jar isn’t quite as popular with other age groups, around a quarter of all respondents said that a jar figures somewhere in their savings plans.

For workers aged over 65, personal ISAs become more important than pension savings. This could mean that individuals are already beginning to draw money from their pension so aren’t using it for future savings – or that they have reached the lifetime savings allowance – the maximum amount of money you save into a pension tax-free.

Neyber’s full report – the DNA of financial wellbeing – can be found here.