Pensions auto-enrolment means that companies of all sizes should now be helping their staff to save for retirement.

A new report from leading Financial Wellbeing Provider, Neyber, tells us more.

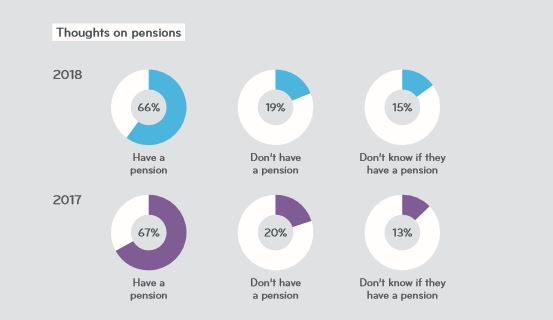

Two thirds of the employees surveyed said that they have a pension, which is in line Neyber’s our 2017 findings (67 per cent).

However, nearly one in five employees (19 per cent) said that they don’t have a pension, and worryingly 15 per cent don’t know if they do or not.

Uncertainty about pensions is at its highest in the youngest and oldest age groups, with 23 per cent of 18-24 year olds saying that they don’t know if they have a pension, and 22 per cent of over-65s. These two age groups are also the most likely to say that they don’t have a pension at all.

Helping employees to understand what they are paying into and why is essential – even if offering a pension is a legal requirement. The relatively high number of employees who don’t know if they have a pension or not suggests that the message isn’t always getting through.

Pensions in detail: savings rates

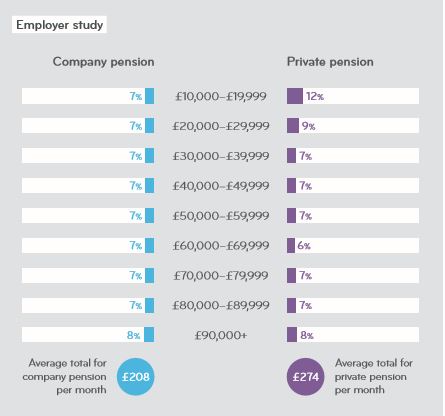

Employees who are contributing to a pension are saving an average of 7 per cent of their salary.

Helping employees to understand whether their retirement expectations match the reality of their pension savings is vital for long-term planning. The later employees start to save for retirement, the more they will need to put aside and the harder their money will have to work for them just at the point they’re looking to wind down.

Neyber’s full report – the DNA of financial wellbeing – can be found here.